child tax credit portal

It also lets recipients opt out of advance payments in favor of a one-time credit when filing their 2021 taxes. Millions of families who werent required to file a federal tax return but are still eligible for the Child Tax Credit or missing stimulus payments from last year can finally claim those tax benefits starting this week.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

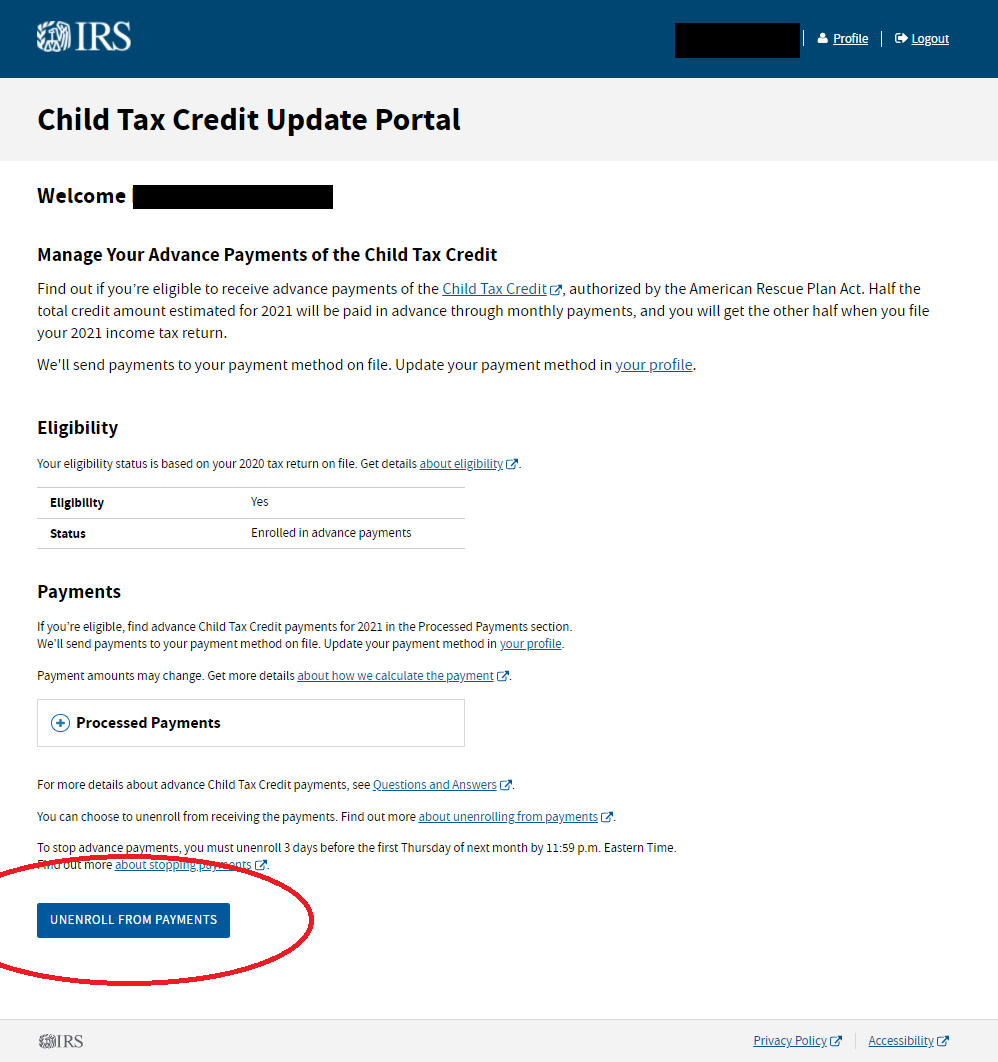

Check if youre enrolled to receive payments Unenroll to stop getting advance payments Provide or update your bank account information for monthly payments starting with the August payment Child Tax Credit Eligibility Assistant Check if you may qualify for advance payments.

. Chabeli Carrazana Economy Reporter Published May 11 2022 103 pm. In a push to ensure more low-income families get a chance to receive enhanced Child Tax Credit CTC payments for 2021 the Biden administration the Treasury Department and the non-profit Code for America organization are promoting an online portal to help families claim CTC benefits without having to file a tax return. Parents of a child under the age of 6 can receive 3600 annually some of.

The advance is 50 of your child tax credit with the rest claimed on next years return. WASHINGTON The Internal Revenue Service this week launched a new Spanish-language version of the Child Tax Credit Update Portal CTC-UP. This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits.

View the Child Tax Credit Update Portal Use this tool to review a record of your. Update your mailing address. Treasury Irs Announce Tool To Help Non Filers Register For Child Tax Credit The Hill Ad The new advance Child Tax Credit is based on your previously filed tax return.

Our child tax credit calculator tells you how much money you might receive in advance monthly payments in 2021 and how much of the credit youll claim when you file your return next year. And Made less than certain income limits. The amount you can get depends on how many children youve got and whether youre.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments.

The portal which will be available until November is now open for families with children who do not file taxes and who have still not received the child tax credit. The Child Tax Credit Update Portal allows users to make sure they are registered to receive advance payments. You can find the advance child tax credit payment information you need to.

You can use the CTC Update Portal to. If you havent and are not required to file a full 2020 tax return you can still get advance payments. Making a new claim for Child Tax Credit.

Claim Your Credits And Deductions To Help You Maximize Your Tax Refund. Eligibility for advance payments Bank account and mailing address Processed payments. You can use it.

13 hours agoIncreased amount. Families can use Child Tax Credit CTC Portal to check eligibility for advance payments get information about monthly payment amounts or opt-out of advance payments. Child Tax Credit Portal Use this tool to.

1 day agoThis year eligible families can use the tool to receive their 2021 Child Tax Credit. If you want to check your eligibility for advance payments get information about your monthly payment amounts or opt-out of advance payments use the IRS Child Tax Credit Update Portal CTC UP to manage your advance payments. Child Tax Credit CTC Sign-up Guide for Non-filers 5 Step 1.

You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year. Filing taxes is how you receive Child Tax Credit payments that you are owed for 2021. The tool also allows families to unenroll from the advance payments if they dont want to receive them.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The Update Portal is available only on IRSgov. Thats because certain information provided by the CTC portal could be out of date.

The initial deadline for opting out of monthly payments has passed but the next one is August 2. People who received advance CTC payments can also check the amount of their payments by using the CTC Update Portal as well as. Use these resources to learn how to claim a child on taxes for the purposes of receiving the remainder of your Child Tax Credit.

The 19 trillion American Rescue Plan which President Joe Biden signed into law in March 2021 made several significant changes to the existing child tax. The Child Tax Credit Update Portal lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. Child Tax Credit Portal is started by IRS for taxpayers.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. 2 days agoThe relaunched GetCTC portal is meant to help recipients navigate the process with a return that requires only the information needed. Provide or update your direct deposit information.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying childIt. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Keep reading to learn more about the child tax credit portal update.

So that they can get some more benefits by paying IRS Tax. The free tool was introduced in the fall of 2021. The IRS is updating the CTC Update Portal over time.

You should use the Child Tax Credit Update Portal CTC UP on the IRS website to let the IRS know about changes to your situation. 2 days agoLow-income families can still get the child tax credit through a new filing portal. Ad Uncover Your Child Tax Credits And Other Deductions When You File With TurboTax.

Filed taxes or completed a non-filer tool and. This tool is designed to help families quickly and easily make changes to the monthly Child Tax Credit payments they are receiving from the IRS. Already claiming Child Tax Credit.

IR-2021-235 November 23 2021. You can use the IRS Child Tax Credit Update Portal to view your payment history and verify that a check has been mailed to you or that you have received direct deposits. Find answers on this page about the child tax credit payment the calculator and why you may want to use the IRS child tax credit portal.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

2021 Child Tax Credit Advanced Payment Option Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Childctc The Child Tax Credit The White House

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back